When I’m helping a client plan his or her estate, one of the most common questions I get asked is, “Should I set up a revocable trust or an irrevocable trust?” Each serves a different purpose. In this post, I’ll outline the difference to help you make the right decision for your situation. As an experienced estate planning attorney, I can help you understand the difference and make the right choice for your assets.

What Is a Trust?

A trust is a legal document where you assign your assets. These include valuable things you own like your home, investments, bank accounts. You name people or organizations who should benefit from the trust. Trusts make it clear how your assets should be distributed after your death.

What’s the difference between a trust and a will?

The legal document called a will states how you want your property distributed after your death. You should name an executor to manage your estate, specifying who should receive your assets, and appoint guardians for your children. Your nomination of a guardian for your children is not binding on a court, but courts generally consider a parent’s wishes.

In Illinois, estates generally require the probate process unless the estate qualifies for a “simplified” process.

What’s the difference between a revocable and irrevocable trust?

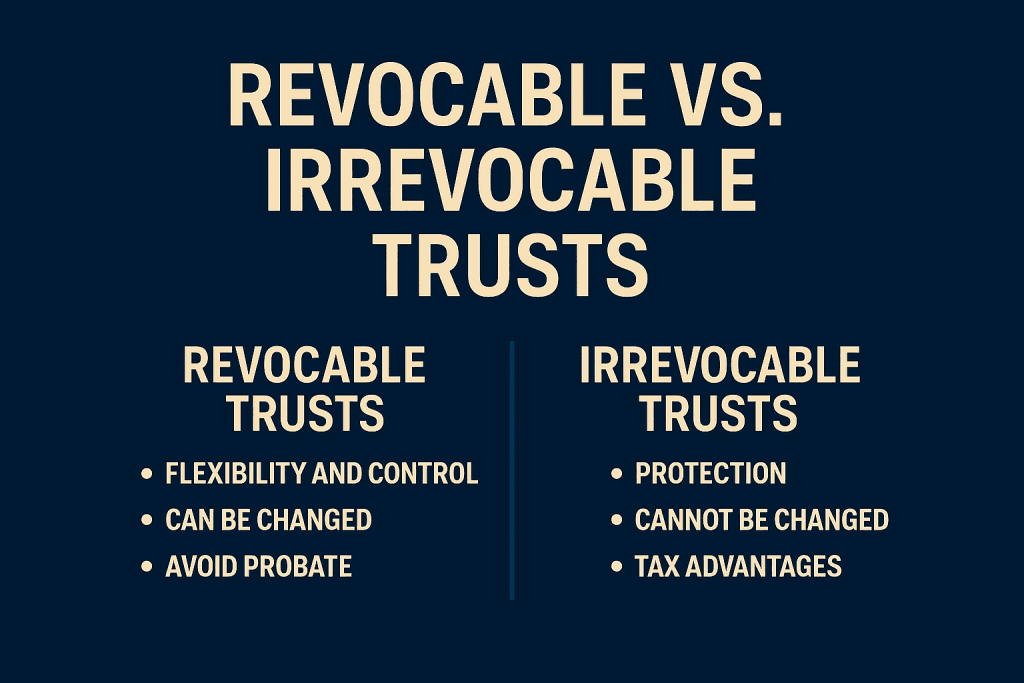

A revocable trust offers flexibility and control. An irrevocable trust is better for asset protection or tax planning. See the table below for more details.

Revocable Trust

A revocable trust, often called a living trust, can normally be changed any time during the client’s life. You can:

- Add or remove assets as you acquire or sell valuables

- Change beneficiaries to different people or entities

- Cancel the trust completely and consider another option

A revocable trust can avoid probate and may keep the details of your estate private. It’s also very flexible. However, if you have debts or are sued, your assets are not protected.

Irrevocable Trust

An irrevocable trust is much more restrictive than a revocable one.

To change the terms of an irrevocable trust, you may need a court’s approval and/or beneficiaries agree to the terms.

One benefit of an irrevocable trust is that the estate taxes may be reduced and the assets are protected from creditors and lawsuits in certain situations.

Trusts in Illinois

The Illinois Trust Code (760 ILCS 3) dictates how trusts are created and managed. In 2025, it was updated:

- Silent Trusts: A silent trust means you don’t have to tell the beneficiaries about the trust until they turn 30 years old.

- New Trustee Duties (Effective January 1, 2025): Trustees must now:

- Trust records must be kept for seven years after the trust closes.

- Trustees must conduct a reasonable search for unclaimed or abandoned property .

Which One Is Right for You? Ask Springfield, IL Estate Planning Attorney Jim Ackerman

As you can see, trusts have a lot of benefits but need to be customized for your individual situation. Call me, Jim Ackerman, and let’s talk about your needs. Together, we’ll create a plan for your goals.